“If the expense ratio goes down, the advisor gets away with not lowering his or her own fee and can keep the client at basically the same all-in level,” said Ahmed. Kashif Ahmed, president of American Private Wealth in Bedford, Massachusetts, said the lower fees can actually mean more money for advisors.

Investor demand for mutual fund services has increased dramatically in the past few decades. Mutual fund expense ratios also have fallen because of economies of scale and competition. First, expense ratios often vary inversely with fund assets.Īnother factor contributing to the decline of the average expense ratios of long-term mutual funds is the shift toward no-load share classes. Several factors help account for the steep drop in mutual fund expense ratios. There are a few key reasons - a surge in fund assets, a shift toward no-load share classes and competition. Hybrid and bond mutual fund expense ratios have also tumbled in that time - hybrid down 34%, bond down 45%, the ICI reports.

The past 20 years have seen a dramatic drop in expense ratios for equity mutual funds, from about 1% in 2000 to a half percent in 2020, according to the Investment Company Institute. In the first week of January 2022, BlackRock cut the expense ratio on its mortgage-backed securities ETF from six basis points to four, and its short-duration Treasury inflation-protected securities ETF from four basis points to three.įrom March 2021 to January 2022, State Street Global Advisors cut expense ratios on a variety of equity and fixed income ETFs, by anywhere from two to five basis points, with the biggest cut on the high-yield bond ETF. Leading the way was Vanguard’s Explorer Fund Value Shares, with a 12 basis point cut, from 0.64% to 0.52%.ĭuring 2021, BlackRock cut expense ratios on a variety of equity and fixed income ETFs, by anywhere from three to 30 basis points, the biggest cut coming on the iShares U.S. There were also cuts in other categories of Vanguard’s equity and balanced mutual funds and ETFs. Treasury and mortgage-backed securities ETFs.

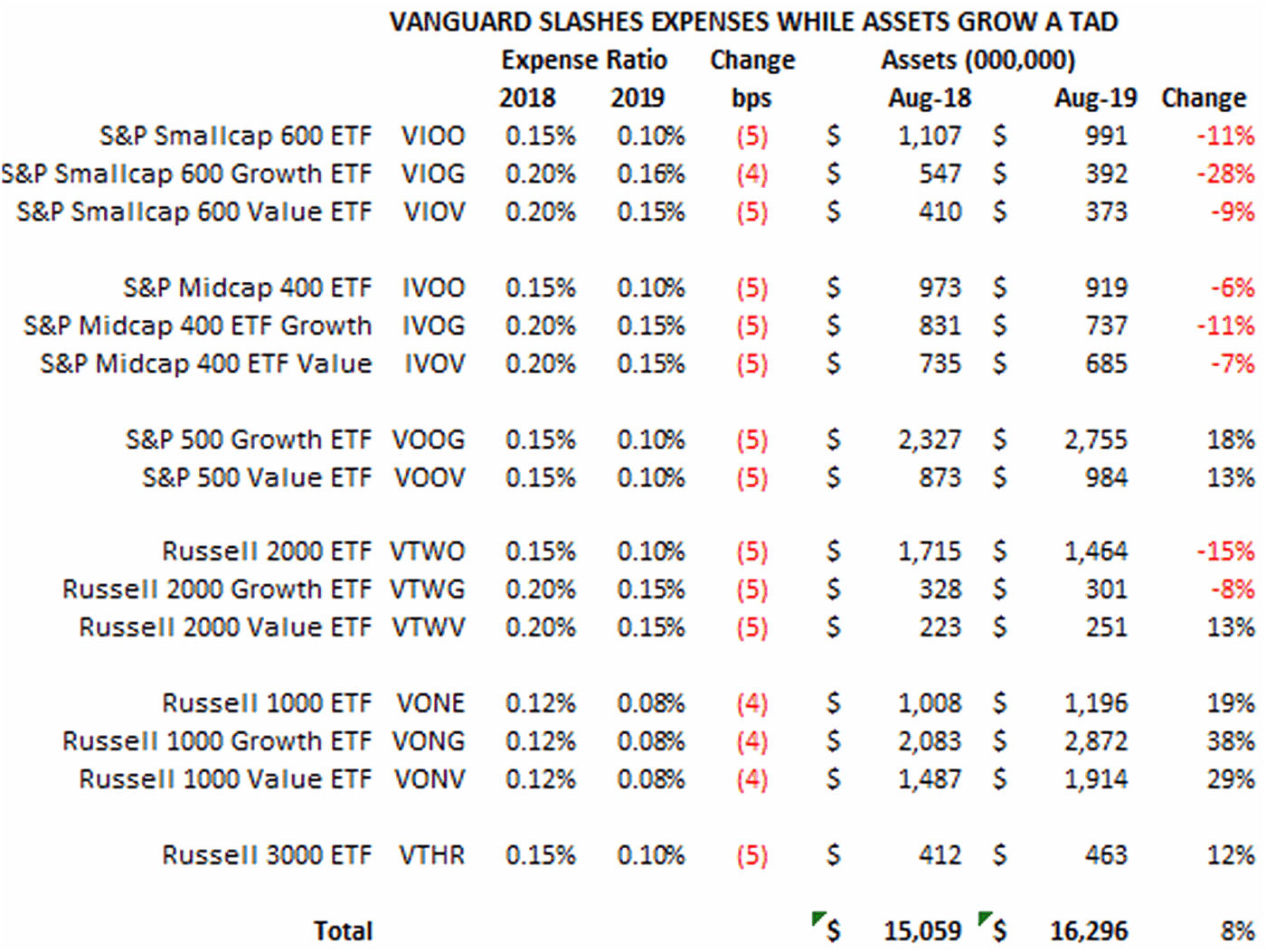

The fixed income ETFs for which Vanguard reported lower expense ratios included corporate credit, U.S. 17, Vanguard reported lower expense ratios for 17 fund shares, including nine fixed income ETFs, resulting, the firm said, in almost $19 million in savings for investors. The cuts ranged from one to five basis points.

0 kommentar(er)

0 kommentar(er)